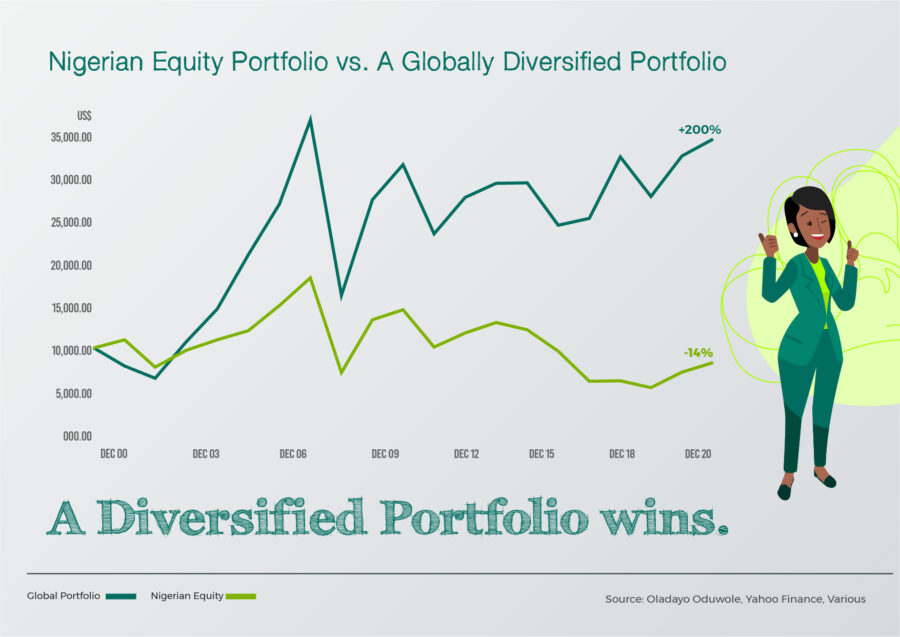

A simple strategy wherein one holds an equally weighted portfolio of equities in sixteen different countries delivers an annualised return of 10%. The associated annual standard deviation is 27%. The strategy suffered a significant drawdown of 52% during the global financial crisis of 2008 but recovered thereafter with a 60% gain in the following year.

The 10% annual return was observed between 2001 – 2020 in dollar terms. Simple diversification works and continues to work. To replicate this, Index funds / Index ETFs replicating country holdings can be utilised. This strategy outperforms a large number of active fund managers over the observation window.